Robotic Process Automation (RPA)

RPA is a software tool to integrate any application to automate routine, predictable tasks using structured digital data. RPA tool operates by deploying software script (also known as ‘bot’) to imitate human task within a business workflow. These bots act like a human inputting and consuming information from multiple IT systems.

An RPA tool possess three core competencies – Low-code/no-code development environment for citizen developers to create bots, integration with enterprise applications through UI interaction, APIs, connectors and a orchestrator (a control dashboard) to manage (configuration and monitoring) bots. In addition, RPA tool may also provide – Mechanisms to align itself with planned changes in the enterprise application/system ecosystem, automated disaster recovery, support for various hosting options, data security and role-based privileges, In-built AI (Artificial Intelligence), ML(Machine Learning) and NLP (Natural language processing) capabilities, process mining and discovery capabilities

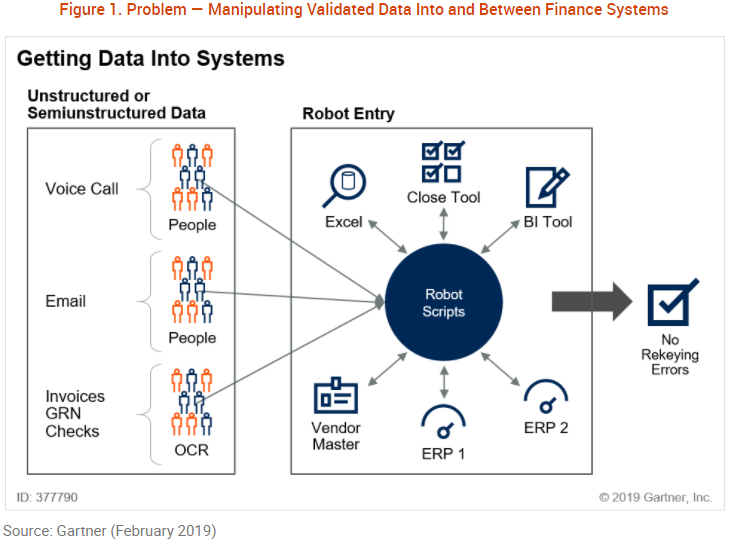

RPA tools are used in mainly three areas – getting data into or between systems, consolidating data into reports or standardized formats and automating a structured, predetermined workflow or building a workflow. Financial institutes have been an early adopter of RPA. Many onerous back-office functions, such as ensuring an up-to-date Know Your Client (KYC) form is filed or a recent credit check is included on a loan application, are ideal for RPA. An RPA tool can be triggered manually or automatically, move, or populate data between prescribed locations, document audit trails, conduct calculations, perform actions, and trigger downstream activities.

Why: Easy to develop bots provide speed to value, high ROI, accuracy, and easy integration

Application leaders apply robotic process automation as a noninvasive integration method to automate routine, repetitive, predictable tasks to unlock tactical benefits. RPA is designed to play nice with most legacy applications, making it easier to implement compared to other enterprise automation solutions. Organizations can take agile approach for implementing RPA solutions as they are scalable, and work well with existing IT infrastructure. Bots are easy to create and integrate using no-code/low-code development environment. RPA streamlines the process and enables strategic analysis by providing event logs. RPA is the least expensive technology of all cognitive solutions and can be a catalyst to digitally transform the company by providing greater productivity, speed to value and high return on investment.

How: Mine, identify and prioritize

An organization can follow below process-flow to deploy RPA solutionFew major vendors for RPA tools are Microsoft Automate and UiPath.

Recommendations: Bots are augmentation of human-workforce

Financial institute, specially a wealth management organization can deploy RPA to accomplish client on-boarding, interactive what-if scenarios, and exception handling in trade processing. The organization can benefit by creating bots that can perform reconciliation by retrieving data in numerous forms from external parties and internal accounting/ recordkeeping systems, formatting information, comparing data sets, and making corrections and adjustments based on defined rules. Bots will be augmentation of human-workforce, carrying out tedious tasks much more quickly and accurately, while employees focus on high-value tasks.

Example of RPA Opportunity

References

- Tornbohm, Cathy (2020). When and Where to Use Robotic Process Automation in Finance and Accounting (ID G00377790)

https://www.gartner.com/document/3902070?ref=solrAll&refval=262289193

- illimity Bank (2020). Illimity Bank simplifies loan process and saves 15 hours a month with Microsoft Power Automate

https://customers.microsoft.com/en-us/story/821782-illimity-bank-banking-power-automate

- Standard Bank – South Africa (2018). The power of four: African bank embraces digitalization and increases efficiency with time-saving Microsoft Power Automate, Power Apps, Power BI, and SharePoint

https://customers.microsoft.com/en-us/story/standard-bank-banking-capital-markets-powerapps

- Naved Rashid (2020). Critical Capabilities for Robotic Process Automation (ID G00465756)

https://www.gartner.com/document/3989821?ref=solrAll&refval=262291979

- Saikat Ray (2020). Magic Quadrant for Robotic Process Automation

https://www.gartner.com/document/3988021?ref=solrAll&refval=262291998

- Davenport, T., Ronanki, R. (2018). Artificial Intelligence in the Real World. Harvard Business Review.

https://hbr.org/2018/01/artificial-intelligence-for-the-real-world

- Porter,M., Heppelmann, J. (2015, October). How Smart, Connected Products Are Transforming Companies.

https://hbr.org/2015/10/how-smart-connected-products-are-transforming-companies

- Microsoft (2020) Get started with Power Automate

https://docs.microsoft.com/en-us/power-automate/getting-started

- Microsoft – Power Automate website